Efficient Property Solutions

Real Estate

Leasing and Investing

Property Portfolio

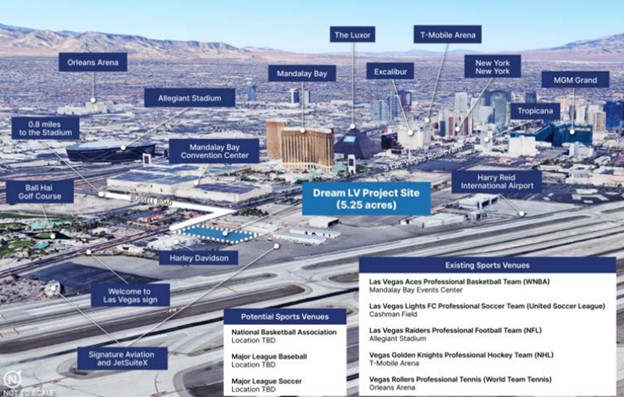

Dream Hotel

Las Vegas, NV. 2024, Full service luxury hotel and casino with 531 suites. 30yr contract acquired & operated by Hyatt.

NYC Tower 56

New York, Prestige Plaza. Trophy class-A tower office. 190,000 SF. Ferrari showroom. Proximity to Central Park & Trump Plaza. Acquired 2022 at 65% of last purchase+retro.

Tesla/Cadillac Commons

Austin, TX. Q3 2026. Closest class A to Tesla World HQ. Current 20,000 employees anticipate 60,000 direct and 100,000 indirect. 367 MF units plus 10 acres commercial. Solar panel carports with chargers. 5th floor power gym. Greystar world-class property management.

GSA

Birmingham, Al. Social Security Admin offices. Only federally leased service center. 600,000 SF.

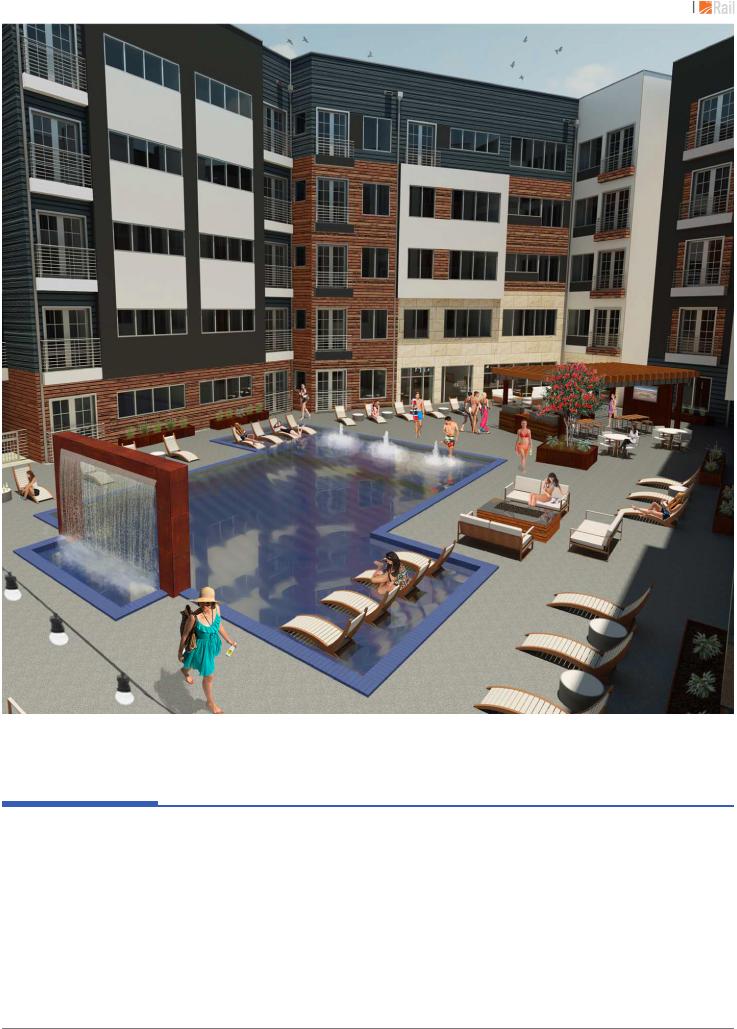

Rail

Austin, Tx. Downtown, class A multifamily 2023- 83% leased. 235 units. Apartments of the future: EV chargers, light rail, cap metro and UT bus route. A few units subsidized with Austin Housing Authority resulting in 100% property tax exemption into perpetuity. $180k per unit construction cost. Greystar property management: the global leader in rental housing.

Grove @ Mustang Ridge

180 single family and 8 4-plexes. 2024-5: Austin water permits on draught hold . 34 acres, 20 min from Tesla World HQ.

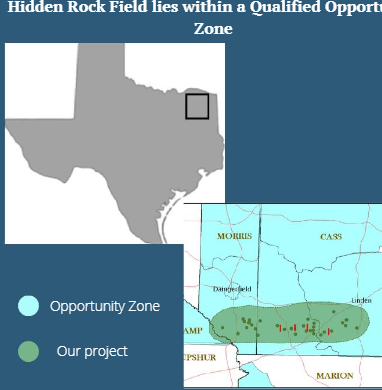

BSR Lonestar Drilling

Cass County, TX. 60,000 acres. One of largest oil and gas field discovery in East Texas Basin in last 30 years. Zero coupon: no federal tax on long term capital gains.

SpaceX

Hawthorne, CA. Wholesale private equity on exceptional caliber corporation. 2018: Falcon Heavy with thrust of eighteen 747 aircraft. 2023: 80% of global orbit payloads. 2024: Starlink IPO. 2029: Starship Interplanetary to Mars. Stock projections: double at IPO in 2024 and 7x by 2032 (thrusting Musk into the orbit of first Trillionaire).

Village at Westland Cove

Knoxville, TN. 240 units, 28 acres. class A. Lake-lifestyle/dock on par with $1m+ residences on scenic Lake Fort Loudon. 98% occupancy in 2023.

10

Senior Housing

Columbus and Leesburg, GA. Senior care assisted living and memory care facilities. Oaks at Grove Park and Oaks at Oakland Plantation. 154 units on 16 acres constructed 2019.

Senior Housing

Cleveland, Ga (Laurel Lodge) and Dallas, Tx (Turtle Creek Memory Care). Alzheimer (double by 2050) and dementia care in “home-like” customized and elegantly detailed interiors. Executive Chef cuisine. 137 beds on 17 acres since 2020.

Private Female Dorm

Tuscaloosa, Al. Walk is class A midrise luxury. University of Al bordering Bryant-Denny Stadium and Sorority row. No competition. Constructed in 2020 as final zoning for new housing in vicinity. Occupancy in 2023 is 100% (with zero no-shows) while market is 30%.

Mineral Rights & Royalties

Anadarko Basin, Oklahoma. Resources Royalty. Six properties each 2-5 producing wells.

Kewaunee Scientific Corp.

Superior line of laboratory furniture and products. Stable industrial 20 year NNN sale lease-back. 470,000 SF on 21 acres.

Vintage

Winter Garden (Orlando), FL. 8 miles from Disney World. Class A with quartz kitchen islands. 340 units on 18 acres built 2021. 2023 occupancy 92% while avg comp 74%. Only damper: Florida property insurance spiraling due to climate change/natural disasters.

Flats at West Alabama

Houston, TX 304 units, Class A, prestigious River Oaks neighborhood. Best in class finishes. 97% occupied, above the 89% regional avg. However, Houston has significant new construction pipeline, and insurance increases 25%+ annually due to climate change/natural disasters. The 2024 largest wildfire in state history will exacerbate.

Lonestar Operating Fund

Early investor in Lonestar construction projects. Completing Town Creek in New Braunfels and Presidio traditional multi-family project in northwest San Antonio. Due to interest rate-sensitive and capital-intensive challenges: on hold is Vance Jackson in Austin ground-break in Q1 of 2024.

100 Fifth Avenue

New York, Midtown South tech corridor, luxury retro 270,000 SF. Purchased at 50% of last purchase in 2013. Closed at 65% occupancy in 2023. Since acquisition, Apple has signed 5 year lease for 4 floors. Plus a SF tenant signed an 11 year lease for 2 floors. We are now at 96% occupancy and very profitable.

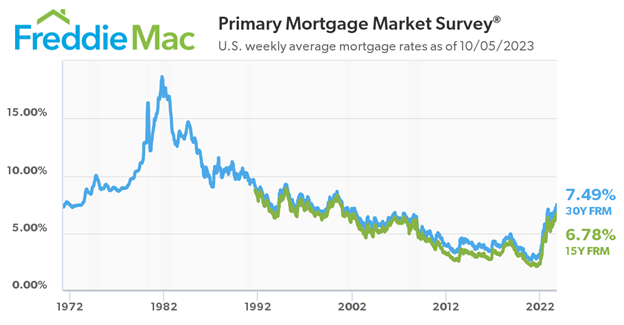

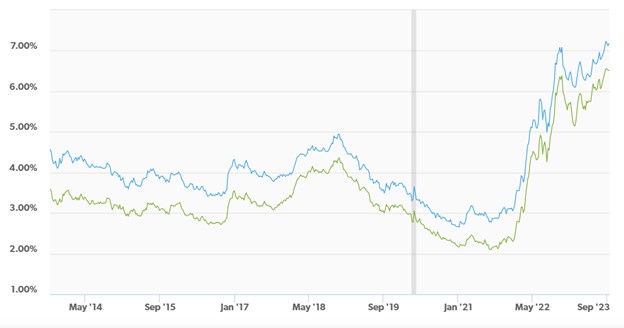

Proven Success in Managing Properties

We are proud to have a track record of successful property investments and leasing options for our clients. Our team is committed to maintaining and increasing property value, while hedging against inflation (oil). We forecast strongest growth in multifamily due to advantages of density, amenity, conveniency, cost and short-term obligations. Renting is $1500 less than average ownership at 7.7% interest rate. The 200+ unit complexes literally daily sign a new contract and adjust to market.

Experienced Property Managers

at Your Service

Our property managers are highly experienced and well-versed in a variety of real estate areas. Trust in their expertise to manage property with optimal results.

25

Properties Managed

93%

Occupancy Rate

15

Property Managers

20

Years of Experience

★ ★ ★ ★ ★

Our research and agile portfolio adjustments and commitment to detail is evident in our partner success. We highly recommend our properties to anyone in need of real estate leasing or investments.

Norman Muraya

/

Your Real Estate Investment Partner

We hurdle property investment barriers

and maximize your profits.

✓ Personalized Approach

✓ Dedicated Management Team

Frequently Asked Questions

What services do you specialize in?

We specialize in investments and work with property management teams with services, including leasing, rent collection, maintenance, tenant screening, and financial reporting.

What are the costs of real estate leasing and investment?

We provide various leasing and investment location options and recommendations. We will provide you with an estimate after evaluating your needs.

How do I schedule services?

You can schedule services by email, calling our office or filling out a form on our website.

What are your payment options?

We offer flexible payment options, including monthly management fees, flat fees, and performance-based fees.

Q: What documents should I prepare for consultation?

We recommend preparing any relevant documents such as location, pricing and targets, and options to compare.

Real Estate News & Updates

Stay current with the latest real estate industry trends and news by reading our blog.

-

Mortgage interest rates (30&15 yr) – highest since 2001.